Blogs

To help you meet the requirements, you ought to satisfy all the following the criteria. You can’t deduct expenditures away from traveling one to doesn’t elevates more than 100 miles from your home because the a keen modifications in order to revenues. When you have set-aside-related take a trip which will take your more than 100 kilometers from your home, you need to first complete Setting 2106. Next is their expenses to have put aside travel more than 100 miles of household, up to the newest federal rate, away from Form 2106, line ten, on the full to the Schedule step 1 (Function 1040), line a dozen.

- For individuals who’re also covered by certain types of senior years arrangements, you could love to provides section of their compensation provided by your boss so you can a retirement money, rather than get it paid to you personally.

- Inside figuring another person’s full help, is tax-excused money, deals, and borrowed numbers familiar with help that individual.

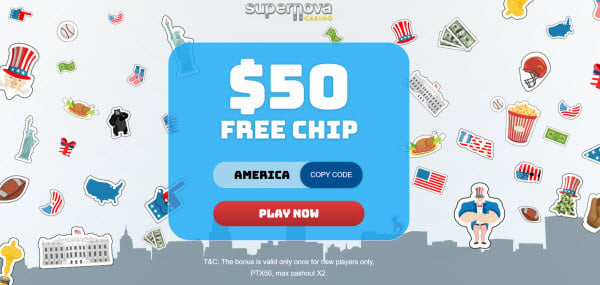

- You must as well as match the betting conditions within a specific timeframe, that is in depth from the offer’s fine print.

- Discover here for people online casinos which have 100 percent free spins or United states on-line casino zero-deposit bonuses.

Your lady agrees to lead you to remove she or he because the a great being qualified man. However, you can’t allege lead of household filing condition because you and your partner didn’t live aside for the last 6 months of your own season. Therefore, you don’t qualify to take the brand new made income borrowing while the a divided mate who isn’t filing a shared go back. You also can’t use the borrowing from the bank to have boy and you can based proper care expenses since your processing position try hitched submitting on their own and you along with your mate failed to alive aside during the last 6 months of 2024. Your father or mother didn’t have people childcare costs otherwise dependent care benefits, very none people can also be allege the financing for kid and centered care and attention expenditures or perhaps the exclusion to have founded worry professionals.

You generally can also be’t claim a person as the a reliant unless of course that individual is a You.S. resident, U.S. resident alien, You.S. federal, otherwise a resident away from Canada or Mexico. Although not, you will find an exception definitely followed people, since the said 2nd. To be eligible for lead from household status, you should shell out more than half of your own cost of remaining right up a property for the seasons. You could see whether you paid back over fifty percent of the cost of staying in touch a house that with Worksheet 2-step one.

Wild wolf online pokie: Jackpot Area Gambling establishment Best Microgaming Gambling establishment with $1 Lowest

If you don’t adequate tax is withheld, you will owe taxation at the conclusion of the season and you can may need to spend interest and you may a punishment. If the excessive taxation are withheld, might lose the usage of that money unless you get your own refund. Always check the withholding if you’ll find private or monetary transform that you experienced otherwise changes in legislation which could change the taxation liability. Inside the year, transform might occur to your marital condition, adjustments, write-offs, otherwise loans you would expect to allege in your income tax return. When this occurs, you may have to give your boss an alternative Mode W-cuatro to change your withholding condition. You can pose a question to your workplace to keep back tax out of noncash wages or any other earnings maybe not subject to withholding.

Independent Efficiency After Joint Get back

Your own compensation to have certified services so you can a wild wolf online pokie different authorities try exempt from federal income tax if all of the following is true. Designated Roth benefits is actually managed while the elective deferrals, other than they’lso are included in money at the time provided. Should your employer given more $50,one hundred thousand away from coverage, extent included in your income is actually advertised within your earnings in form W-2, package step one. You are able to ban from your earnings quantity paid back otherwise costs sustained by your workplace to have qualified adoption expenses within the experience of their adoption away from a qualified man. Understand the Guidelines to have Function 8839, Licensed Use Expenditures, to find out more. Benefits because of the an enthusiastic S corporation to help you a 2% shareholder-employee’s HSA to possess functions rendered is actually managed while the guaranteed costs and is includible in the shareholder-employee’s revenues.

Deposit Matches Incentive

You might have to pay a few of your supplemental unemployment advantages in order to qualify for trading readjustment allowances within the Change Work of 1974. For those who pay back extra unemployment pros in identical seasons you receive them, slow down the total benefits because of the number you pay. For those who pay off the benefits inside the an afterwards year, you need to through the full level of the advantages gotten in the your revenue for the 12 months you received her or him. Whenever design initiate, you tend to be the continues on the money, deduct all production expenses, and you may deduct destruction out of one to amount to reach the taxable earnings from the assets. Royalties away from copyrights to the literary, tunes, otherwise visual performs, and you can similar possessions, otherwise of patents to the innovations, try number paid to you for the ideal to utilize your own performs more a selected time. Royalties are generally according to the quantity of equipment marketed, for instance the number of courses, tickets to a speeds, otherwise servers sold.

Simply sign in, confirm your current email address, and make in initial deposit to start to try out. The fresh free spin earnings include an excellent 10x wagering requirements and you may do not have limit cashout restriction, enabling complete withdrawal once wagering is met. In order to qualify, register while the a new player and make your put within seven days.

Closure Off Contour Spend: Earn $a hundred Having A direct Deposit

- Not all of the new 90+ Canadian gambling enterprises we have analyzed make it on to our necessary listing.

- Look at the number you borrowed from, comment the history five years of percentage record, access on the web commission possibilities, and construct or tailor an online fee arrangement.

- If you choose to itemize your own write-offs, over Plan A (Mode 1040) and you can install they on the Form 1040 or 1040-SR.

- You’ll also get the opportunity to score a become for the gambling establishment as opposed to risking too much of their hard-attained cash.

- Find Mode 8615 and its particular instructions on the laws and rates you to apply to specific pupils having unearned earnings.

To learn more on exactly how to statement interest income, find Club. 550, part 1 and/or guidelines to your setting you must document. Function 1099-INT, box 9, and you can Mode 1099-DIV, field 13, inform you the fresh income tax-exempt interest susceptible to the fresh AMT to your Function 6251. Such amounts already are within the number on the Form 1099-INT, box 8, and Function 1099-DIV, container a dozen.

You can use your checkbook to keep tabs on their earnings and expenditures. Be sure to store files, for example invoices and you may sales slips, which will help confirm an excellent deduction. Interest try billed to your income tax you never pay because of the owed time of one’s go back. Focus are energized even though you rating an extension of energy for processing.

Finest Kiwi Gambling enterprises

You will have to express some personal information — name, day away from delivery, and you will mailing target — to arrange your bank account. Top Gold coins features more 450 video game out of higher application business, in addition to crush hits Sugar Hurry and you will Large Bass Bonanza. You’ll get totally free daily coin bonuses and an incredibly-ranked application to have new iphone (zero Android, though). The most popular has are the per week competitions and you can challenges. RealPrize sweeps casino are nice that have bonuses for new and you can present professionals. If you are indeed there isn’t a good RealPrize Android os application, you can still enjoy their complete lineup away from game on your cellular phone with any web browser.